Analyzing potential mispricing in a spin-off: Stora Enso

With references to Joel Greenblatt's "You Can Be a Stock Market Genius"

Have you ever opened your brokerage account to find a news alerting that a company you own is spinning-off a major business segment? A flurry of questions come into your head then: Is the company in trouble? Should I sell my remaining shares before the spin-off? Or should I buy more?

Fortunately, the legendary investor Joel Greenblatt has talked quite a bit about how corporate shake-up often hides significant market inefficiencies and highest returns. In this article, we are going to analyze Stora Enso’s plan of spinning-off its Swedish forest assets (ForestCo) from the industrial segments (RemainCo). Ultimately, I am going to show you how this Stora Enso story may mirror some of the study cases Greenblatt has written in his book.

(apologies for using similar intro to my previous article on assessing asset sales.. check that article out if you are interested! I analyzed Elkem’s divestment there)

Case Study: Stora Enso

(numbers are taken as of 25 January 2026)

Stora Enso intends to separate their Swedish forest assets business into a new publicly listed company. It will be Europe’s largest public pure play forest company, comprising over 1.2 million hectares of forest land in Sweden with a fair value of approximately 5.7B euro [1].

The opportunity?

In September 2025, Stora Enso sold 12.4% of its Swedish forest holdings for 900M euro [2]. This means that the implied market value of the remaining 87.6% Swedish forest holdings that are going to be spun-off is 6.36B euro instead of the fair value of 5.7B euro.

Why the over-priced buy? My guess: wind power. Stora Enso has identified a huge potential for 20 TWh wind power on its land, based on a presentation in June 2024 [3]. Swedish wind power generation in 2022 is about 33 TWh, according to Wikipedia. So this is huge!! Though this is only 12.4% of the total 20 TWh potential. One of the buyers, Soya Group, has built a self-sufficient residential properties (for 8,000+ tenants) in Stockholm through its wind farm [4]. In addition, Stora Enso still retains 15% ownership, secures wood availability from the area, and will manage the forest-related service. So, everyone wins I suppose!

In any case, with the remaining Swedish forest assets of 6.36B euro, this implies that the value of the rest of the segments (RemainCo) is 1. 88B euro (8.24B market cap – 6.36B ForestCo). The RemainCo includes:

Packaging materials: global leader in circular packaging providing premium packaging boards, made from virgin and recycled fiber (in line with EU packaging legislation)

Packaging solutions: packaging converter that produces premium fiber-based packaging products for leading brands across retail, e-commerce and industrial applications

Biomaterials: pulp products, aiming to create innovative bio-based solutions that replace fossil-based and other non-renewable materials

Wood products/sawmills: Europe’s leading provided of sustainable wood-based solutions for building sector.

Finnish forest assets: valued at 0.9B euro (6.6B euro of total owned forest assets - 5.7B euro of Swedish forest assets, from Q3 2025 report pp 19 [5])

NOTE: If we take this into account, the implied value of the rest of the segment is even lower i.e. 1.88B euro – 0.9B euro = 0.98B euro! But we will not take this into account to be conservative.

Others: basically just costs i.e. Group’s shared services, administration and shareholding of partly-owned companies

The valuation for the RemainCo?

Looking at P/S (market cap / revenue) of similar companies i.e. industrial wood + sawmill + packaging solution companies with/without forest assets:

Stora Enso’s historical: 1.0x

Amcor PLC (packaging, no forest assets): 1-1.2x

Mondi PLC (packaging, with forest assets): 0.6-1.4

Billerud AB (packaging, with forest assets): 0.6-1.2x

SCA (industrial wood, with forest assets): 4.0-5.5x

Using P/S of 0.6-1.2x, the implied Market Cap of RemainCo should be about 3.72B to 7.44B euro - which is far away from the 1.88B euro calculated before. This is a potential of 200%-400% upside!

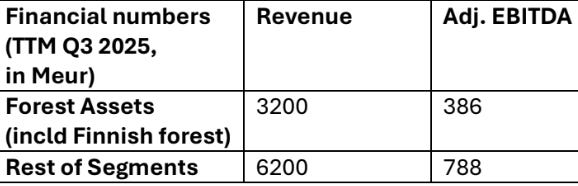

Now let’s look at multiple that takes into account the debt - EV/EBITDA.

In order to calculate RemainCo’s EV, we need to calculate its Net Debt:

Q3 2025 report states that their net debt is 3.2B euro with cash & cash equivalents of 2.2B euro. This implies total debt of 5.4B euro.

Thankfully, Stora Enso has a specific report dedicated to their debt structure, which consists mostly of green bond [6]. From this report in pp 2, 82% of 2.43B euro is allocated to “sustainable forest management“, amounting to ~2B euro. This “forest“ bond can only be tied to their forest assets, thus ForestCo’s total debt is 2B euro.

From this information, it can be assumed conservatively that if the RemainCo takes the rest of the debt 3.4B, this amounts to about 63% of their total debt. Assuming same percentage for net debt, this implies that RemainCo’s net debt to be ~2.0B euro.

RemainCo’s EV: market cap + net debt = 1.88B + 2.0B euro = 3.88B euro

Let’s look at a reasonable EV/EBITDA for RemainCo:

Stora Enso’s historical: 6-15x

Amcor PLC: 10-14x

Mondi PLC: 5-10x

Billerud AB: 5-15x

SCA: 12-15x

Using EV/EBITDA of 6-10x, the implied EV of RemainCo should be about 4.29B to 7.88B euro - again quite a bit away from the EV of 3.88B euro. This is a potential upside of 10-200%!

Some points to consider:

The implied 1.88B market cap and 3.88B EV assume that the income from their Finnish forest asset to be negligible. This makes the estimation conservative.

Stora Enso’s numbers are affected heavily by the investment ramp-up in the Oulu packaging board line (about 1.1B euro in 2025, Q3 2025 report pp 3). Their EBITDA and EBIT are realistically higher when the ramp-up is finished. This makes the estimation conservative.

Stora Enso’s interest-bearing debt is not only green bonds. They also have pension liabilities, deferred tax and other liabilities that amount to about ~3.0B euro (5.4B euro total debt - 2.43B euro green bond). This would realistically be distributed proportionally to ForestCo and RemainCo. Thus, the assumption of RemainCo taking all the non-forest bond debt also makes the estimation conservative.

The relevant economic sector cycles for Stora Enso e.g. constructions, premium packaging in Europe and the Nordics are currently bottoming. This makes the estimation conservative.

Related to above, timber price is at multi-year low levels due to low construction and packaging demand. Thus, it is possible that the low volume demand is balanced out by the low timber prices. This makes the estimation NOT conservative.

ForestCo - albeit the boring business - is the “good“ business in this spin-off in my opinion. It provides stable and bond-like earnings. If demand is low, they just let the trees grow to be harvested when demand comes back again.

RemainCo is the “bad“ business in this case due to cyclicality (a price-taker of a commodity i.e. timber) and execution risk.

Insiders?

The largest shareholders are Solidium Oy (Finish State) and FAM AB (the Wallenberg family, largest owner of Investor AB), with about 10-11% ownership each. This unfortunately does not mean anything for the spin-off.

However, some interesting things are announced in their remuneration plans [7, 8] and AGM 2026 proposal [9]:

The annual remuneration for the members of the Board of Directors is to be paid in Company shares and cash. Board members must use 40% of their fixed annual fees to purchase Stora Enso R shares within two weeks after the Q1 2026 interim report (i.e. in Q2 2026). This also occurred in 2025 without any subsequent massive insider selling. This “forced conviction“ might be a way to low-key conduct insider buys at depressed valuation without alerting the general public, which might be a stretch yes, I’m well aware - though the largest shareholders are practically part of the board members, so the people who wrote the mandate are the people who have to follow it. Go figure.

The Group CEO Hans Sohlström remains with the "RemainCo," incentivized by a stock-based remuneration package that locks his wealth into the RemainCo’s turnaround (Earnings Per Share and Total Shareholder Return targets) through 2028. Important to note that he is an experienced turnaround expert (Ahlström Capital, Rettig Group).

Additionally, in the 2024 remuneration report it is stated that “Stora Enso recommends and expects the CEO and other Group Leadership Team members to hold Stora Enso shares at a value corresponding to at least one annual base salary“ - which I think is both Finnish and Swedish ways of saying that they MUST hold shares with a nominal value of 1x of their annual base salary.

The risk?

Commodity cycle risk. Post spin-off, if timber stock supply contracts and timber prices start to increase, the ForestCo will have increased margins, while the RemainCo segment will have decreased margins due to increased input costs. This is a huge threat for the RemainCo’s margins. Nevertheless, the collaboration between ForestCo and RemainCo is supposed to continue decades after the spin-off.

Interest expense risk. If the RemainCo actually gets a low Market Cap valuation and the 2.0B net debt as in our calculation, this may lower RemainCo’s credit rating, leading to higher interest expense and a risk that a big part of the cash flow will be used to serve debt interests. If low demand continues while interest expense stays high, the possibility of a bankruptcy or a massive rights issue is there.

“Green” packaging legislation. The EU regulations on packaging [10] may disrupt the paper and plastics packaging industries. This is a real risk for RemainCo, since the packaging segment contributes the most cash flow.

Similarity to Joel Greenblatt’s study cases

Stora Enso’s spin-off situation somewhat parallels some study cases written in Joel Greenblatt’s “You Can be a Stock Market Genius”. It combines the Sears’s valuation arbitrage and the Marriott’s management alignment.

1. The Sears Parallel: arbitraging partial spin-off to analyze mispricing

In the early 1990s, Sears was a giant, unloved conglomerate. It owned a massive retail and other businesses, but also valuable assets: Dean Witter (brokerage) and Allstate (insurance).

Partial spin-off: Sears sold 20% of Allstate to the public (an IPO) and spun off Dean Witter. By analyzing the market value of Sears’ stake in Allstate + Dean Witter spin-off, one may infer that the Sears’s RemainCo was valued far too cheap when compared to its market cap.

(I will not go into the numbers here, but you get the concept. Buy the book if you want to know the details, you cheapskate!)The Stora Enso Parallel: the partial sale of the forest asset sets a clear market price for the ForestCo. The RemainCo’s value can then be inferred and it is evidently (or arguably) clear that it is currently valued far too cheap compared to its market cap.

2. The Marriott Parallel: the captain is heading the “bad“ ship

In 1993, Marriott was splitting into two:

Marriott International (The “Good” Co): The asset-light, high-margin management company (the brand).

Host Marriott (The “Bad” Co): The debt-laden, asset-heavy real estate company (the hotels themselves).

The captain: the key architect of the spin-off - Stephen Bollenbach - stays with the “Bad” Co Host Marriott.

The outcome: four months after the spin-off, Host Marriott nearly tripled.

Insiders’ stake: the Marriott family still owned 25% of the “Bad“ Co after the spin-off, assuring that Host Marriott’s success was still in their personal interests.The Stora Enso Parallel:

The “Good” Co: “ForestCo” (stable, bond-like).

The “Bad” Co: the industrial “RemainCo” (cyclical, execution risk).

The captain: Hans Sohlström (CEO) is staying with RemainCo. He is not taking the easy job running the forest bond-proxy. His long-term incentives are tied to increasing EPS and TSR.

Insiders’ stake: the board - whose members practically are representatives of the largest shareholders - is structurally committed to buying shares in the open market in Q2 2025 and Q2 2026 as 40% of their total annual remuneration.

So, what to do now with Stora Enso?

Well, this article is not an investment advice… so do your own due diligence!

(Read the disclaimer below!)

My personal view: I believe there will be several entry points to exploit this potential mispricing. Depending on what we see during these entry points, one can either aggressively buy, do nothing, or sell completely if one already hold some shares. You should decide for yourself regarding your own actions, but here are the entry points:

Now: no other supporting evidence except the assumptions yours truly just wrote… do not forget that I also mentioned the risks!

Q1/Q2 2026: restated spin-off plan and potentially official pro-forma numbers. Pay attention to the total debt distributed to RemainCo.

Q2/Q3 2026: board purchases as mandated. Whether they keep their shares may be a good input for external investors.

H1 2027: watch for the potential spin-off dips.

Now I wonder if I should just keep this investment thesis to myself… Anyway, any feedback and comments are appreciated. Please subscribe and be safe out there!

Disclaimer: I am not a licensed financial advisor. I may hold positions in the securities discussed. The content provided in “The Northside” is for informational and educational purposes only and represents the personal opinions of the author. It is not intended to be, and does not constitute, financial, investment, legal, or tax advice. Investing involves risk, mostly the risk of losing money because you listened to a stranger on the internet. Do your own due diligence.

References

[1] https://www.storaenso.com/en/newsroom/regulatory-and-investor-releases/2025/11/stora-enso-completes-strategic-review-and-intends-to-create-the-largest-listed-pure-play-forest-company-in-europe-inside-information

[2] https://www.storaenso.com/en/newsroom/regulatory-and-investor-releases/2025/5/stora-enso-divests-12-4-of-its-swedish-forest-holdings-for-an-enterprise-value-of-eur-900-million-inside-information

[3] https://www.storaenso.com/-/media/documents/download-center/documents/investor-relations/2024/forest-field-trip-presentation_3.pdf

[4] https://www.soyagroup.com/en/real-estate/wind-power-for-8000-tenants/

[5] Stora Enso Q3 2025 financial report: https://www.storaenso.com/-/media/documents/download-center/documents/interim-reports/2025/storaenso_results_q325_eng.pdf

[6] https://www.storaenso.com/-/media/documents/download-center/documents/investor-relations/2024/se_green-bond-report-2024.pdf

[7] https://www.storaenso.com/-/media/documents/download-center/documents/annual-reports/2024/storaenso_remuneration_2024.pdf

[8] https://www.storaenso.com/en/investors/governance/remuneration

[9] https://www.storaenso.com/en/newsroom/regulatory-and-investor-releases/2026/1/proposals-of-the-shareholders-nomination-board-to-stora-enso-oyjs-annual-general-meeting-2026#:~:text=The%20shares%20will%20be%20purchased,the%20purchase%20of%20Company%20shares.

[10] https://www.ecosistant.eu/en/eu-packaging-regulation-e-commerce/